What Does Coronavirus Mean to the EB-5 Industry

The Coronavirus and EB-5

As the coronavirus spread across the globe, countries closed borders, shut down non-essential businesses and implemented shelter at home orders. Undoubtedly, COVID-19 had and continues to have human and economic impact of unprecedented proportions, affecting nearly every community and every industry.

In order to better understand its impact on EB-5, let’s review what the EB-5 program stands for. The EB-5 is foremost an investment program. It gives foreign investors the opportunity to invest in a U.S. business, most commonly commercial real estate project, that creates at least 10 U.S. jobs in exchange for obtaining a permanent U.S. green card. The program is widely referred to as immigration by investment, which explains the two biggest motivators for its participants: fast and easy immigration to the United States and investing in attractive U.S. opportunities.

The Coronavirus Impact on Investing

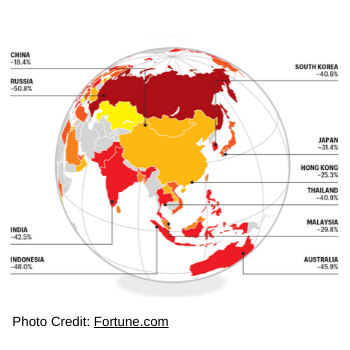

Markets around the world swiftly reacted to the news of the global pandemic. Some of the worst hit markets in respect to a drop in stock indexes were Colombia (-58.3%), Brazil (-57.8%), and Russia (-50.8%). The S&P 500 fell 31% in a month’s time from late February through late March, resulting from investor panic and selloffs. As demand for bonds increased, U.S. Treasury yields reached all-time lows and the Federal Reserve cut interest rates to zero, making bonds less profitable.

Thus, investors with liquid capital and looking for more value opportunities with income generation have shifted their focus on a more traditional asset, real estate. According to Gallup’s annual Economy and Finance survey conducted April 1 through 14th, real estate’s popularity has surged. It has been the favored investment since 2013 and one of the top investment choices since 2016. Forbes’ April article also points to commercial real estate as a stabilizing asset class with potential for income and added value in the future.

While the real estate investing boost may be positive news for the EB-5 industry, a concern about the coronavirus’s financial impact on foreign investment remains. For affluent foreign individuals who have experienced substantial loss of capital due to the market contraction, the EB-5 visa may now seem less affordable. Others, whose businesses have been sidelined by their government’s pandemic response, may feel a more urgent need to liquidate these businesses and seek a new beginning in safer grounds.

Two major factors may drive foreign high net worth individuals to invest in the EB-5 program during the coronavirus pandemic. One is the fear of political instability and serious civil unrest as poverty strangles their own homelands. And two is the worry of losing their financial capital due to imminent inflation and economic collapse in their own countries. These two factors, reinforced by positive government support and stimulus packages like those of the United States, may encourage investors to pursue safer grounds where they can spend their retirement years and secure a better future for their children.

The Coronavirus Impact on Immigration

With interrupted international flights and closed USCIS offices, the coronavirus is likely to have an impact on immigration and slow down immigration services, or at least as it pertains to certain visa types. Not only that but it may possibly influence immigration policies. Let’s explore how EB-5 would be affected directly and indirectly.

1. EB-5 and President’s Trump COVID-19 Executive Order

On April 23, President Trump signed the Executive Order “Proclamation Suspending Entry of Immigrants Who Present Risk to the U.S. Labor Market During the Economic Recovery Following the COVID-19 Outbreak”. The Executive Order bans the issuance of immigrant visas to those physically outside the United States, with certain exceptions. While the proclamation seeks to protect the growing number of unemployed Americans, it does not affect the EB-5 Immigrant Investor program. Here is what an EB-5 prospect needs to understand in relation to the policy:

- Any new investor who plans to make an investment via the EB-5 program is not affected.

- If your I-526 Petition has been approved, you can file and obtain an immigrant visa abroad.

- Current green card holders who wish to file I-829 Petition are unaffected.

- USCIS will continue processing I-526 and I-829 Petitions

- The executive order would not impose delay on processing EB-5 related petitions.

Auspiciously for EB-5, the Executive Order had no direct impact on it, but it directly affected other immigrant visas. Whether that leads to an increased EB-5 interest is yet to be seen.

2. Other Visas and Indirect Impact

Four U.S. senators have sent a letter to President Trump asking for suspension of all new guest worker visas, including the H-1B, for at least 60 days. Their plea came amid news of more than 22 million Americans who filed for unemployment. If the President enacts such a request, it would mean no new H-1B holders would be able to enter the country for at least 60 days, which in turn may cause their sponsoring employers to utilize domestic work force to fulfill their need. This in turn would cause the already approved H-1B visas of people abroad to be forfeited because their sponsors would no longer be able to provide the same promised jobs.

Current H-1B holders are also likely to be affected by the coronavirus pandemic since their legal status is dependent on their employment. Unfortunately, with many U.S. employers enacting furloughs, layoffs and salary reductions, H-1B visa holders are at risk of losing their visa status or even losing eligibility for lawful permanent residence with pending green cards sponsored by their former employers, if they are laid off or furloughed.

While the above may not directly affect the EB-5, it does have some side effects. This is important to note because holders of H-1B visas have in the past constituted a decent percentage of those applying for the EB-5 visa. USCIS data shows, for example, that nearly 50% of South Americans who received EB-5 visas in FY19 were not living in South America, but already residing in the U.S. on different visas. Similarly, 31% of the EB-5 visas to Europeans, and 34% of those to Indians, went through status adjustment in the U.S.

The increased travel restrictions, likelihood to loose their sponsorship and other factors of uncertainty may actually drive more foreign nationals to switch their H-1B visa to EB-5 visa.

3. Economic Impact

The coronavirus has wreaked havoc on the U.S. economy, driving unemployment rate to historic highs. As of May 14, 2020 the tally of jobless claims reached 36.5 million. America is in need of new jobs and capital influx fast.

Interestingly, in the wake of the last U.S. recession, back in 2008 and 2009, the EB-5 program was recognized as an economy boosting tool. By one estimate, the program created over 276,000 jobs and contributed more than $37 billion to U.S. GDP between 2010-2015. The EB-5 Investment Coalition shared a report claiming that the EB-5 program was 500% more efficient at creating jobs than the 2009 American Recovery and Reinvestment Act, i.e. the ‘stimulus’ bill. By their accounts, the ‘stimulus’ bill created one job for every $100,000 to $400,000 in public spending, whereas the EB-5 visa program created tens of thousands of jobs at no cost to U.S. tax payers.

So, it comes as no surprise that in March an EB-5 visa expansion was reportedly under consideration by the Trump administration as cited by Politico. It stands to reason as the EB-5 program makes capital available during economic recessions and banking crises that it can be utilized as an economic recovery tool. “The EB-5 Immigrant Investor Program is a great way for foreign investors to start a new chapter while simultaneously helping boost the U.S. economy and job market, it’s a win-win for everyone,” said Richard Marquard, Executive Vice President of The LCP Group, a 45-year real estate investment management firm based in New York.

The Coronavirus Impact on New EB-5 Projects

On November 21, 2019 several changes to the EB-5 Immigrant Investor Program went into effect. As part of the Modernization Rule, high-unemployment TEA (Targeted employment area) designations would no longer defer to designations made by state and local governments. This inherently was interpreted as making it harder for future sourcing of TEA qualifying projects with more attractive returns or profitability.

However, with new unemployment rates being reported in areas that were previously non-TEA, EB-5 firms may now be able to develop projects in attractive regions that may qualify as TEA. This makes a difference for the EB-5 investor not only because of higher potential for a return but also on securing value. The minimum required investment for TEA qualifying projects is $900,000 while the investment for non-TEA projects is $1.8 million.

EB-5 Outlook Post Coronavirus

Regardless of market fluctuations and sentiment, JLL research reports that the overall investment trend has been for higher allocations to real estate, given the long term advantages of real estate investing. And the EB-5 program will continue to be a sought after source of property financing.

When you add to that political and socioeconomic drivers abroad, we foresee an increased interest and demand for the EB-5 program, which offers a fast path to permanent residency in the country with the largest economy in the world.

While 2020 might be a difficult year for many industries, foreign investors can still find investment opportunities in the U.S. and secure their wealth while simultaneously obtaining a permanent resident card via the EB-5 program. If you are still looking for a reason to invest in this program, here are 10 reasons why investors pursue an EB-5 green card.

Obtain more information on attractive investment projects with potential for a permanent U.S. green card.