How to Compare EB-5 Projects’ Structure and Choose the Right One

There is so much information on the web about the subject of the EB-5 Program, yet not enough has been written on how to make sense of the investment structure of EB-5 projects. How to compare EB-5 projects’ structure and choose the right one can be a daunting task for a new investor. Here is what you need to know as an EB-5 investor.

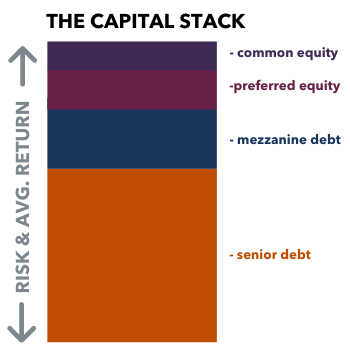

Understanding the EB-5 Project Capital Stack

Most commonly, an EB-5 investment entails investment in a commercial real estate project, such as multi-family residential housing, hotel, office or retail space, etc. Naturally, a commercial real estate project has a capital stack. In simple terms, the capital stack lists the different types of capital invested in the project. On the bottom of the capital stack, in the most secure position, is typically a senior loan, and on the top is typically common equity, traditionally the riskiest investment position in terms of priority of distributing the cash flows of a property. There can also be varying positions in between.

Understanding the various investment structures across the capital stack is critical to analyzing the risk and return exposure and making the right decision when comparing different EB-5 projects.

Senior Loan – Bottoms first

The senior loan also called senior debt is often the largest component of the capital stack, usually 50% to 75% of the full capital stack. It is most commonly thought of as a traditional bank loan because it is secured by a mortgage or a deed of trust on the property itself. It has the lowest level of risk to the lender because it would be first in line to be repaid or take over the lien of the property in case it defaults. Because of the lower risk, a senior loan has the lowest target return.

It is also important to evaluate the loan-to-value (LTV) ratio of the loan. For example, if the loan has a 60% LTV there is a lot more margin for error than an 85% LTV loan.

Mezzanine Loan – Subordinate to the Senior Loan

A mezzanine loan sits between the senior loan and the equity. Because of that position, it has payment priority after the senior loan and before all equity. It generally offers higher average target returns than senior debt.

The mezzanine loan has traditionally been one of the most common capital structures for EB-5 projects, given its size and the typical number of jobs created by a project. Mezzanine debt offers the potential for strong risk-adjusted returns, particularly late in the cycle when common equity investments may carry a higher degree of risk.

When considering investing in mezzanine debt, one should review the experience of the real estate firm executing on the investment, the creditworthiness of the borrower, the quality of the underlying asset and the strength of the market. Mezzanine debt investors should also be aware of the overall leverage of the project across senior debt, mezz debt, and any other bridge financing. The debt service coverage ratio and the total loan-to-value ratio should remain relatively conservative to the offered rate of return.

Preferred Equity – Flexible Structure

Similar to mezzanine debt, preferred equity fills a gap between the senior loan and equity component of the overall project’s capitalization. Preferred equity investors get returns distributed before common equity holders, but after mezzanine debt holders. Because of that preferred equity is considered less risky than common equity, but the upside return potential may be capped.

Preferred equity is not straightforward to understand. In some cases, this type of equity can function like subordinate debts but pay a fixed return. In other cases, it could work just like common equity but have superior payment rights to common equity holders.

Common Equity – Biggest Payoff

Common equity holders typically have an equity interest in the property ownership, but they have lower priority than preferred equity holders when it comes to interest distribution or payoff. They are last in line to be repaid in case of a liquidation, but they may also earn outsized returns because of the risk they take.

While common equity is viewed as the highest risk of the capital stack, not all common equity investments are created equal. Certain common equity EB-5 projects may mitigate the downside risk for passive investors by projecting a healthy risk-adjusted return.

EB-5 Capital Structure Attributes That Matter

Understanding the capital stack in an EB-5 project is important, but it does not give you the whole picture of the puzzle. Several qualitative and quantitative attributes impact the attendant risk and potential upside.

1. Capitalization Rates

Cap rate is the ratio of the net operating income (NOI) to the fair market value or sale price of the property, typically calculated on an annual basis. The capitalization rate can help compare the performance of properties of similar size in a similar location.

2. Market

If an EB-5 project is located in gateway markets like New York or San Francisco for example, it may be less risky, but with less upside potential. In contrast, lesser-known secondary and tertiary markets may offer more growth opportunities, but have greater risk due to less established, less diverse local economies. “Choosing an EB-5 project in the path of growth is a strategy that has brought forward many successful investments for our EB-5 regional centers and their investors,” explains Francis Lively, CEO and President of The LCP Group, a 45-year-old real estate investment management firm.

3. Business Plan

EB-5 projects display a variety of risk/return profiles based on the underlying strategy. From cash flow and the in-place rent to the amount of capital expenditure needed and the complexity of the project, many elements go into the business plan of an EB-5 investment. An EB-5 investor should study and compare business plans carefully.

An element of confidence to alleviate investors’ risk is the fact that often the general partner investor (the developer or EB-5 sponsor) will invest their own money as some portion of the equity to demonstrate alignment of interest. Knowing that the sponsor has skin in the game can bring more peace of mind for the investors.

Being cognizant of the different investment structures across the EB-5 capital stack and what attributes have an impact is vital when comparing different EB-5 projects and making the right choice. For risk-averse investors, senior or mezzanine debt may be more appropriate. For risk-tolerant investors, who may be more in-tune with the real estate investment world, equity investments may be better suited. However, after many years of a bull market with scarce good-value equity investments, the coronavirus disruption is expected to create a wide array of new real estate opportunities across markets and across the capital stack. Savvy investors don’t shy away from the opportunities of a lifetime and stand ready to seize the opportunities in a distressed market.

Obtain more information on attractive investment projects with potential for a permanent U.S. green card.