At The LCP Group, we provide comprehensive investment solutions that go beyond hotels and net lease properties. With decades of experience, we focus on diverse commercial real estate sectors, including office, industrial, multi-family, mixed-use, and entertainment properties. Our dedicated team applies the same rigorous underwriting and asset management across all asset types, ensuring risk-adjusted returns for our investors. LCP’s ability to identify and capitalize on opportunities across the entire commercial real estate spectrum positions us as a versatile and trusted partner in the market, maximizing value for our clients.

15+

Investments Structured Since 2014

$500+ Million

Capital Invested Since 2014

Asset Class: Multi-Family

Platform: Common Equity (EB-5)

Inception Year: 2024

Status: Active Investment

Investment Description: Fair Lakes consists of the strategic repurposing of two high-quality office buildings into a 55+ age-restricted active adult community. The adaptive reuse of the existing structure is not only more economical but also provides the project with a competitive advantage relative to the market by offering tenants higher ceiling heights than typical multifamily buildings and a greater sense of privacy due to the low noise transmission between the concrete floor plates.

Fair Lakes is situated within the Washington D.C. MSA in the western portion of Fairfax County, Virginia, which was recently ranked as the 5th most affluent county in the nation by U.S. News & World Report. The immediate area benefits from economic anchors including the federal government, private companies that service the federal government, and the growing tech industry.

Asset Class: Office

Platform: Mezzanine Loan (EB-5)

Inception Year: December 2017

Status: Active Investment

Investment Description: The ground-up construction of a 201,450-square-foot, office building and six-story parking deck is a built-to-suit design for AvidXchange, Inc. (NASDAQ: AVDX).

Asset Class: Mixed-Use

Platform: Preferred Equity (EB-5)

Inception Year: 2017

Status: Active Investment

Investment Description: The Harlow project is a Class-A, transit-oriented high-rise, residential apartment development in the heart of Washington, D.C. It has 143 market-rate-apartment units across a 10-story, elevator-served structure overlooking the Canal Park (and an additional 36 affordable rate units under a separate condominium regime).

Asset Class: Mixed-Use

Platform: Preferred Equity (EB-5)

Inception Year: 2018

Status: Active Investment

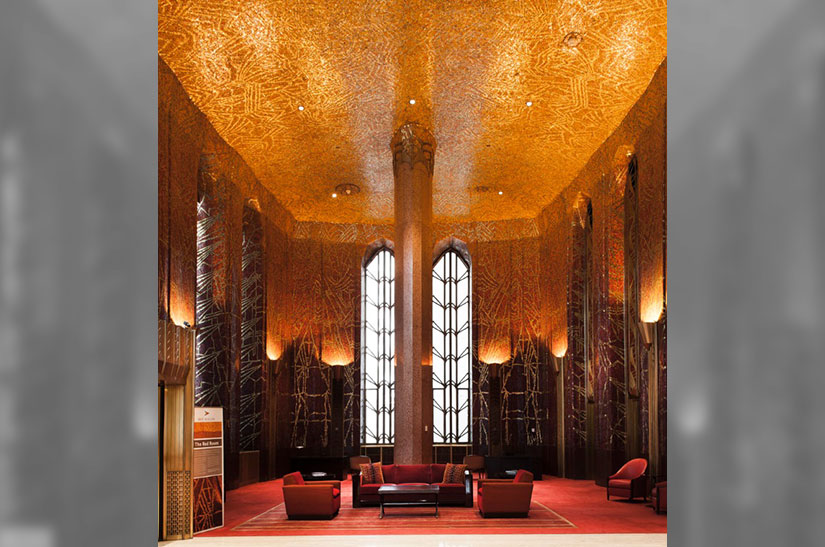

Investment Description: The 1 Light Street Project is a Class-A, mixed-use office, residential apartment, retail, and parking development located at the intersection of Light and East Redwood Streets in downtown Baltimore, Maryland. The Project was designed as an urban tower with nine floors of office space totaling approximately 246,170 SF, topped by 10 floors of residential space, containing 280 apartment units. The building has garage parking (two floors below grade and seven floors above the lobby level), a rooftop with an infinity pool and sundeck, three outdoor terraces, and many other amenities. There is also approximately 5,675 SF of retail space on the ground floor. M&T Bank signed a lease for approximately 155,506 SF.

Asset Class: Multi-Family

Platform: Preferred Equity (EB-5)

Inception Year: 2019

Status: Active Investment

Investment Description: The project is a Class A, transit-oriented residential apartment development known as The Kiley, which has 315 apartment units in an 8-story elevator-served structure. The building has 99 parking spaces, a fitness center, a pool, in-unit laundry, fully controlled access, bike storage, and storage units. With units averaging 719 square feet, the project offers a unique and highly desirable living experience that combines a transit-oriented location, Class-A finishes, and the satisfaction of being in the heart of one of the United States’ most thriving cities, close to employment and amenities.