The RIGHT EB-5 PARTNER FOR YOU

Choosing an EB-5 partner can be hard, especially when investment security and a return on your investment are primary concerns.

45+ years of experience as a real estate investment manager

$5 billion total EB-5 project value

1,000+ green card applications with 100% approval rate*

34,000+ jobs for U.S. workers

15+ EB-5 projects

7 U.S. regional centers

*All qualified investors have been approved.

The LCP Group, L.P. (LCP) is one of the few real estate investment management firms in the EB-5 space and has capitalized more than $500 million in debt and equity transactions into development projects with an aggregate value of more than $5 billion.

Our team of professionals focuses on analyzing project viability, job creation, investment security, USCIS compliance, and exit strategy execution.

Email us now to learn more about our attractive investment opportunities with risk-adjusted returns

Private Meetings

We have a few spots remaining for private meetings:

- New York City

- New Jersey

- India (multiple cities)

Email us to schedule a private meeting to discuss EB-5 and our unique investment project in Charleston, South Carolina.

EB-5 Seminars

Join us to learn more about EB-5 and our high-yield investment opportunity in Colorado Springs, Colorado.

Exclusive EB-5 Opportunity: Industrial Property with Projected High Returns

FREE Webinar on demand

Watch now to learn more.

FEATURED LCP EB-5 PROJECT

ATTRACTIVE INVESTMENT PROJECT IN COLORADO SPRINGS, COLORADO

LCP’s latest EB-5 project is a build-to-suit manufacturing facility in Colorado Springs, Colorado. An affiliate of LCP will acquire, develop and lease the property to a single tenant, bio365, for a 25-year term. Bio365 is a high growth, patented soil manufacturer for Controlled Environmental Agriculture (“CEA”) with a strong pipeline and high conversion rate and a clear path to growth.

The strategic location of Colorado Springs is home to diverse manufacturing facilities with over 400 manufacturers located in the region. Located in warehouse supply-constrained location, demand for light-industrial warehouses will continue to grow.

Aside from the positive macro trends, Colorado Springs also presents strong local fundamentals. It was voted the Most Desirable Place to Live by U.S. News & World Report in 2018 and 2019. A forecast by Realtor.com ranks Colorado Springs as No. 7 among the nation’s Top 10 housing markets for 2020. Colorado Springs is among the top cities for tech talent growth, ranked No. 4 on CBRE’s Annual List of Up-and-Coming Tech Markets.

PROJECT DETAILS

Project type:

Single Tenant Net Lease

Project Sponsor:

The LCP Group L.P.

Tenant:

bio365

Lease Term:

25 Years

Construction Start Date:

Q4 2020

Construction End Date:

Q3 2021

Minimum Investment Amount:

$900,000 USD for EB-5 investors; $100,000 USD for qualified U.S. or foreign investors.

Total EB-5 Investment Amount:

$4,500,000

Investment Type:

Common Equity

Investment Term:

~10 Years

Targeted Internal Rate of Return:

between 13%-19%*

Job Creation:

86 jobs

Opportunity Zone Eligible:

Yes

Projected information subject to change. *The final IRR may differ from that of the projections based on several assumptions made by the GP, including but not limited to (i) the total amount raised in the Fund which may expand the number of projects the Fund can complete, (ii) the duration required to complete any particular project, (iii) the degree of leverage used across one or all projects, (iv) the capitalization

EB-5 PROGRAM OVERVIEW

What is the EB-5 visa program?

The EB-5 Immigrant Investor Program was created in 1990 by the United States Congress to stimulate the U.S. economy through foreign investment and create jobs for U.S. workers. The EB-5 program is administered by the United States Citizenship and Immigration Services (USCIS), and provides each participating foreign investor the opportunity to obtain a green card by investing in a new commercial enterprise in the United States that creates 10 jobs for U.S. workers. The current minimum investment amount is $900,000 provided the project is in a Targeted Employment Area (TEA) and is $1.8 million in other areas.

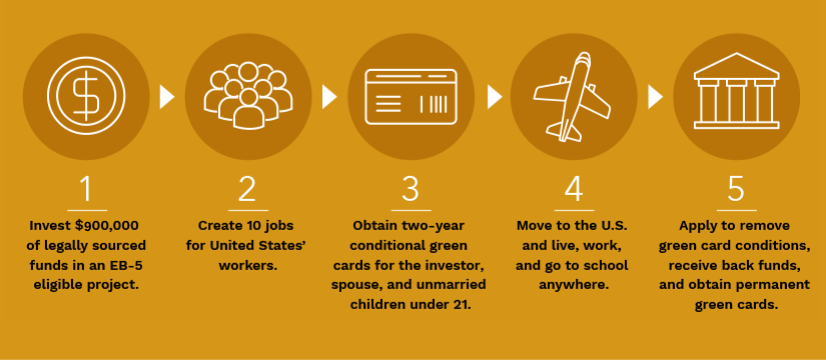

How does the EB-5 program work?

At a high level, there are five core steps to the EB-5 program:

What are the advantages of EB-5 over H-1B and other visas?

Your ability to live in America will not require sponsorship and therefore is not dependent on your employer, H-1B, F-1, or other visas. You are also not required to live in the location of your EB-5 project. As a permanent resident, you can live, work, own property, form a business, and attend school anywhere in the United States

How do I choose the right investment partner and/or regional center?

Choosing the right investment partner is not easy and there are many considerations. It is important to choose a firm that has extensive investment management experience and a strong track record of success.

The LCP Group, L.P. (LCP) is one of the few real estate investment management firms in the EB-5 space and has capitalized more than $500 million in debt and equity transactions into development projects with an aggregate value of $5 billion.

$5 billion total EB-5 project value

1,000+ green card applications with 100% approval rate*

34,000+ jobs for U.S. workers

15+ EB-5 projects

8 U.S. regional centers

*All qualified investors have been approved.

LCP employs a team of professionals to facilitate our selection of eligible investments with a focus on analyzing project viability, job creation, investment security, USCIS compliance, and exit strategy execution. Our value proposition stands above the rest—we uniquely offer you:

- More than 45 years of experience as a real estate advisor and investment manager

- High-yield opportunities with economic returns that compensate you for your risk

- Alignment of interest—we co-invest with you, so our money is at risk too

Email us now to learn more about our attractive EB-5 investment projects.

*Required Fields

©2020 The LCP Group, L.P. All rights reserved. This video and the information contained herein does not constitute an offer to sell or the solicitation of an offer to purchase any securities. Any such offer or solicitation may only be made by means of delivery of a Confidential Private Placement Memorandum (the Memorandum) as updated and supplemented from time to time, which will contain material information not included herein. The information contained herein is not complete, is subject to material changes and, if an offering of the EB-5 Investment Opportunity is made, will be superseded by the Memorandum in its entirety. Any decision to invest in the EB-5 Investment Opportunity described herein should be made after reviewing the Memorandum, conducting such investigations as you deem necessary or appropriate and consulting your own legal, accounting, tax and other advisors in order to make an independent determination of the suitability, merits and consequences of investment in such EB-5 Investment Opportunity.

In the event that an investor was within the United States during any solicitation regarding a potential investment, then such investor will be subjected to heightened verification under Rule 506(c) of Regulation D of the Securities Act of 1933, which will require submission and verification of accredited status through one or more of the following: (i) income tax returns, (ii) banking and investment account statements, and/or (iii) a written confirmation from a registered broker-dealer, licensed attorney, or certified public accountant certifying that such investor has satisfied the accredited investor requirements of Rule 506(c).