SWITCH YOUR H-1B VISA TO AN EB-5 VISA

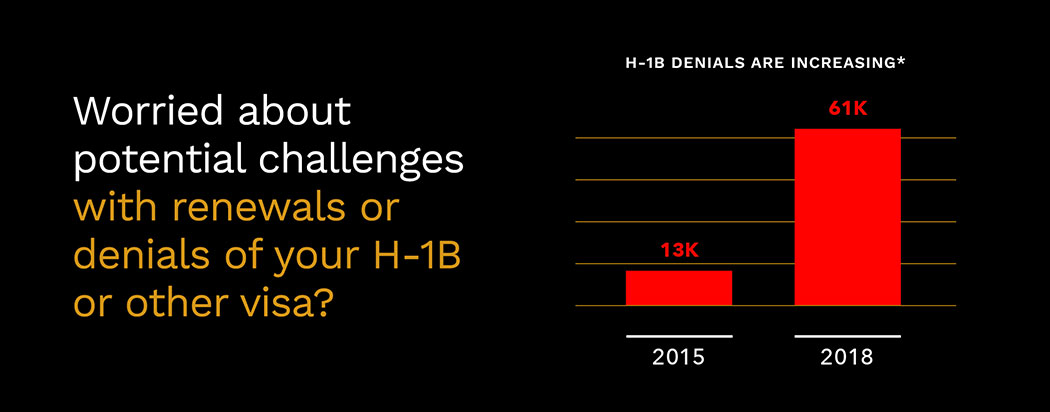

If you are living in the U.S. on an H-1B or other visa and are concerned about potential challenges with renewals or denials, then switch to a permanent EB-5 investor green card that does not require employer or other sponsorship.

EB-5 VISA COMPARISON

Investment requirement:

$800,000 USD for a qualified EB-5 investor

Green card status:

Permanent

Green card allocation:

Investor, spouse, and unmarried children under age 21

Sponsorship requirement:

None

Work restrictions:

None, apply for any job at any company that you like in the U.S.

Residence restrictions:

None, live anywhere you like in the U.S.

School restrictions:

None, apply to any university that you like in the U.S.

Entrepreneur restrictions:

None, move your existing business or start a new business in the U.S.

CHOOSING AN EB-5 PARTNER

The LCP Group, L.P. (LCP) offers direct access to foreign investors seeking to capitalize on real estate investment opportunities in the United States—with or without the opportunity for a permanent U.S. EB-5 green card.

50 years of experience as a real estate investment manager

$5 billion total EB-5 project value

1,000+ green card applications with 100% approval rate*

34,000+ jobs for U.S. workers

15+ EB-5 projects

7 U.S. regional centers

*All qualified investors have been approved.

We actively pursue projects with strong underwriting fundamentals and offerings include both debt and equity investments giving sophisticated investors the opportunity to choose the preferred level of risk and return they are seeking on their capital.

LCP is one of the few real estate investment management firms in the EB-5 space and has capitalized more than$500 million in debt and equity transactions into development projects with an aggregate value of more than $5 billion.

Our team of professionals focuses on analyzing project viability, job creation, investment security, USCIS compliance, and exit strategy execution.

FEATURED LCP EB-5 PROJECT

ATTRACTIVE OPPORTUNITY IN ATLANTA, GEORGIA

LCP originated a $43.35 million construction financing for the Moxy Centennial Olympic Park, located in Atlanta’s downtown entertainment district.

AMENITIES The 10-story, 183-room property will have a rooftop restaurant and lounge, a lobby bar, and ground-level retail. The hotel is scheduled to open during the second quarter of 2026.

LOCATION Situated in Atlanta’s Centennial Park District, the property will be a short walk from local attractions including the Georgia Aquarium, World of Coca-Cola, State Farm Arena, and the Mercedez-Benz Station, home to the Atlanta Falcons and Atlanta United FC of Major League Soccer. Guests will be able to access the Georgia World Congress Center, Atlanta’s 3.9 million square foot convention center, and several corporations, including Georgia Power Company, AmericasMart, The Coca-Cola Company, Truist, AT&T Wireless, Emory Healthcare, and Georgia State University.

PROJECT DETAILS

Contact us now to learn more about our high-yield opportunity with the potential to obtain a permanent EB-5 green card.

*Required Fields

*Based on “Initial Denials” in the United States Citizenship and Immigration Services report dated 1/2/2019, https://www.uscis.gov/sites/default/files/USCIS/Resources/Reports%20and%20Studies/Immigration%20Forms%20Data/BAHA/non-immigrant-worker-rfe-h-1b-quarterly-data-fy2015-fy2019-q1.pdf

©2020 The LCP Group, L.P. All rights reserved. This video and the information contained herein does not constitute an offer to sell or the solicitation of an offer to purchase any securities. Any such offer or solicitation may only be made by means of delivery of a Confidential Private Placement Memorandum (the Memorandum) as updated and supplemented from time to time, which will contain material information not included herein. The information contained herein is not complete, is subject to material changes and, if an offering of the EB-5 Investment Opportunity is made, will be superseded by the Memorandumin its entirety. Any decision to invest in the EB-5 Investment Opportunity described herein should be made after reviewing the Memorandum, conducting such investigations as you deem necessary or appropriate and consulting your own legal, accounting, tax and other advisors in order to make an independent determination of the suitability, merits and consequences of investment in such EB-5 Investment Opportunity.

In the event that an investor was within the United States during any solicitation regarding a potential investment, then such investor will be subjected to heightened verification under Rule 506(c) of Regulation D of the Securities Act of 1933, which will require submission and verification of accredited status through one or more of the following: (i) income tax returns, (ii) banking and investment account statements, and/or (iii) a written confirmation from a registered broker-dealer, licensed attorney, or certified public accountant certifying that such investor has satisfied the accredited investor requirements of Rule 506(c).